Facebook starts looking vulnerable sooner than anyone expected!!! 😲😲😲😲

|

| Mark Zuckerberg | David Paul Morris/Bloomberg |

Everyone knew that at some point Facebook wouldn’t be

able to continue posting eye-popping revenue growth and profit margins.

It wasn’t a dream or an exaggeration by cautious Facebook

Inc. executives. The company’s financial results are weakening, just as

executives warned they would a few months ago.

Everyone knew that at some point Facebook wouldn’t be able

to continue posting eye-popping revenue growth and profit margins. What was

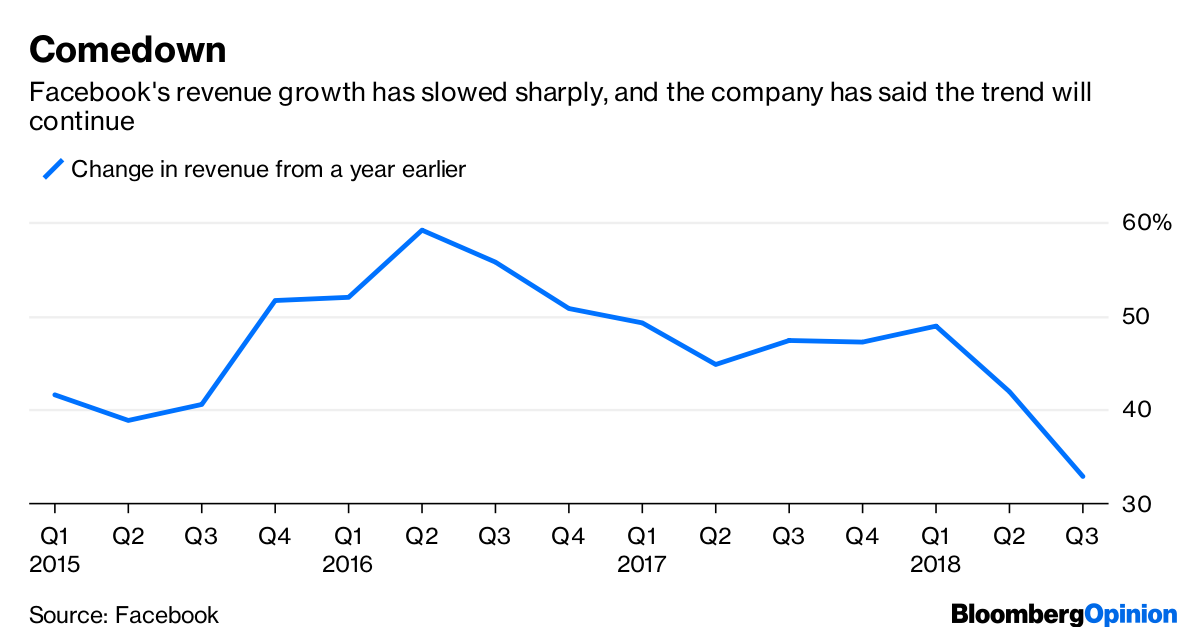

surprising was how quickly the brakes came on. Early in 2018, Facebook’s

revenue growth was nearly 50 percent. Facebook disclosed on Tuesday that its

third-quarter revenue rose 33 percent from a year earlier — about in line with

the rate of slowdown the company warned investors about in July. It wasn’t

setting a low bar at the time; it was being truthful about a business that has

deteriorated quickly.

If Facebook’s caution flag is correct, its growth rate will

slow further to 27 percent or so in the fourth quarter, or nearly half the

growth pace from the first quarter of this year. That’s a stunning slowdown for

any company. Facebook has always been proficient in squeezing more advertising

sales from everyone passing through Facebook’s digital doors. In the third

quarter, however, the average revenue generated for each user rose 20 percent

from a year earlier — impressive for most companies, but the slowest rate for

Facebook since 2013.

|

| Facebook’s revenue growth has slowed sharply |

Spending continues to boom even as revenue growth wanes,

with the largest increase coming from a category of costs for running

Facebook’s computer data centers and paying for contracts with web video

partners. Facebook CEO Mark Zuckerberg told stock analysts that 2019 would be a

year of “significant investment,” implying the company’s profit margins will

continue to shrink.

It adds up to a drastic change in condition for one of the

best corporate success stories of the last decade. Investors had believed

Facebook would lead the technology pack in growth and profits for years to

come, but that expectation has changed. Facebook’s conference call with

analysts was littered with cautions that the activities to which people are

gravitating — private messages on WhatsApp and Messenger, web videos on

Facebook, and video-and-photo diaries called stories on Instagram and Facebook

— are promising, but will be tough to immediately turn into revenue at the

company’s usual rate. This is no longer the muscular Facebook that could do

little wrong financially. This is a company that has suddenly hit a dangerous

patch where much could go wrong.

The thin ribbon of silver lining is that there wasn’t more

bad news on Tuesday. In Europe, where a recently adopted digital privacy law

threatened to crimp Facebook, the number of daily users of Facebook or its

Messenger app inched down only marginally in the third quarter. The number of

people using Facebook or Messenger in the U.S. and Canada didn’t budge. That’s

not good, and it continues a trend of flatlining use in Facebook’s most

important advertising market, but at least there are no signs that people are

fleeing in droves.

Zuckerberg was clear that use of the main social network has

hit a saturation point in developed countries such as the U.S. The trouble is

that Facebook use will tilt toward countries where the company’s ad sales are

smaller than they are in North America and Europe.

The big problem is that investor confidence in Facebook has

been shaken from the company’s stark financial warnings over the summer plus

repeated missteps on everything from violent extremism within Facebook’s

internet walls to the departure of multiple senior executives. The loss of

confidence infects everything at Facebook.

The company always seemed sure-footed in pacing the

financial blossoming of its products. When the main social network lost a bit

of luster with internet users and advertisers, the company had its Instagram

app ready and waiting to pick up the revenue slack. It was a seamless hand-off

for a while.

Investors anticipated the products that were next in line to

march through Facebook’s prodigious money-making engine: its TV-like web video

hangout, then Messenger, WhatsApp, virtual reality technologies and who knows

what else. But now that investors aren’t so sure about Facebook’s near-term

financial prospects, they also lost faith in Facebook’s ability to keep passing

the money-making baton to the rest of its products.

It’s no longer a sure thing that Facebook will figure out

how to harness people’s changing internet behavior in a way that generates the

growth and profits that investors have come to expected. That Facebook — with no

assurances of success — appears to be real and not a mirage. –

Bloomberg

Tags: Facebook, Mark Zuckerberg

EmoticonEmoticon